Fintech, which is short for financial technology, is one of the hottest industries today, leading the way in introducing innovative solutions in the financial services industry. It comprises companies who are leveraging technology to deliver financial solutions to consumers using completely new service models.

The use of technology in the financial industry started with institutions like banks improving efficiencies in their back-end processes. But the advent of PayPal changed it all. Fintech companies today are increasingly leveraging the digital eco-system to come up with disruptive business models. Some of the key areas in which fintech companies are operating are payment processing, lending & financing, financial management including banking.

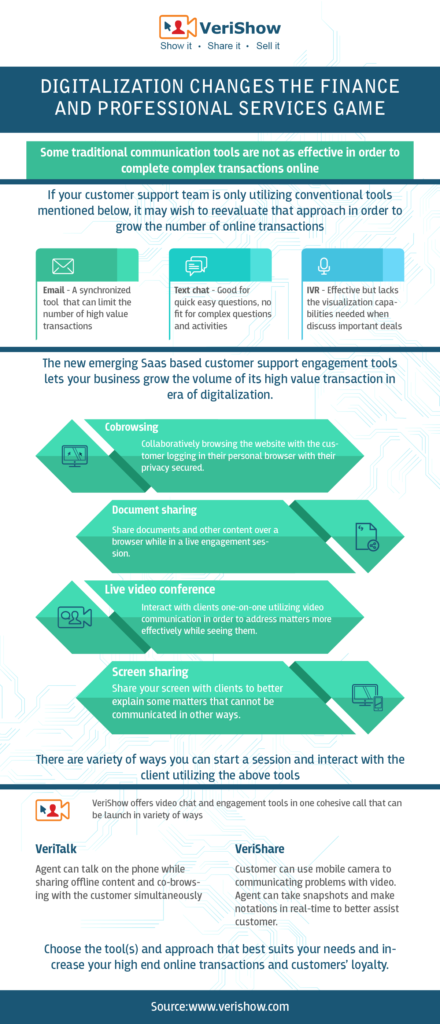

These companies are breaking the mold in terms of servicing a customer’s financial needs. Traditionally every financial transaction, be it a loan, a transfer or even a deposit, involves a lengthy process – an in-person visit, discussions with the concerned officials, numerous documents and signatures.

But this is changing with fintech companies. By utilizing online platforms, fintech companies can now easily deliver their services online, even the complex ones thanks to a wide variety of tools and technologies available.

Real-time collaboration technology such as co-browsing and live chat offers a significant opportunity for fintech companies to engage interactively with their customers, removing a key hurdle of needing to have brick-and-mortar infrastructure to deliver customer service. Simple yet powerful, these easy-to-deploy tool s are a great fit for the lean operational set-up of fintech companies, and for the often-confusing and daunting financial transactions:

- Explain your products & services interactively: Co-browsing and video chat are great tools to introduce your product or service to your customers. Customer support staff can use these tools to interact face-to-face and take the customer through the details. Instead of just reading an FAQ section, these tools enable the customer to speak to a real person who would take the time to explain the features, the advantages and clear any doubts that might come up.

- Guide the sales process: Since fintech companies often route their entire sales activity through online channels, tools that allow real-time interactions and bridge the gap of lacking in-person dealings are invaluable. Co-browsing and live chats can be leveraged by the sales staff to step in at the right time to help the customer make the decision and provide support such as answering questions, providing additional documentation etc.

- Exchange and review financial documents together: Financial transactions can involve complex documentation. Screen sharing will enable your sales staff to share the screen with the customer easily, enabling them to provide inputs and assistance which provides confidence and reassurance to the customers.

- Use website as customer support channel: With these tools in place, you don’t need to set up a separate customer service channel. Live chats, co-browsing and screen sharing are very effective in providing instantaneous and interactive support.

Benefits Of Using Real-Time Collaboration Products

Fintech companies can benefit widely from deploying real-time collaboration platform on their websites:

- High Quality Customer Service: Co-browsing along with live chats enables you to engage easily with your customer and build a rapport. The human touch gives reassurance to the customers, improving customer adoption of your service.

- Secure and Easy to install: Real-time collaboration tools are easy to install, needing only a browser and internet connection. No software installations or hardware is involved which makes it a very cost-effective solution. It is also secure end-to-end, giving you the confidence to transfer confidential information without fear of compromising it.

- Improved Sales Productivity: By using these tools, your sales staff has the ability to build a deep understanding of the customers’ needs, their buying behavior and preferences. By offering improved engagement and differentiated service, the productivity of sales personnel is increased

Flexible Delivery Model: This technology platform can be deployed across both desktop and mobile seamless, providing you with the flexibility and scalability to use as you need.

0 Comments

Leave A Comment